We have spent a lot of time speaking about the recovery plan and Obama’s future plans to cutting the deficit. We have however forgotten to discuss the most important aspect of all of this. What happens after we fix the problem?

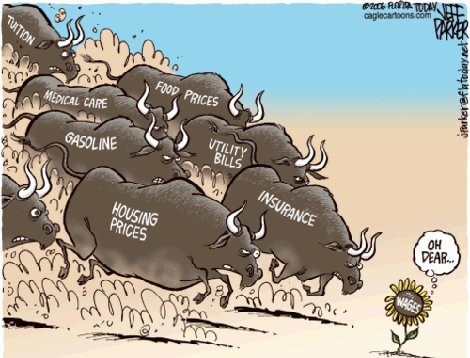

We are faced with many issues, which all are a danger to our way of life but we have to consider the biggest most eminent threat to the economy: inflation.

Inflation is defined in simple terms as the increase in cost of living. The cost of goods becomes very unaffordable, so does energy and real estate. It is somehow similar to a recession as its an adjustment of markets but in the opposite sense. Demand goes to the roof so in order to combat supply shortages, we must raise prices to accommodate only the few that can afford them.

Why do we face inflation?

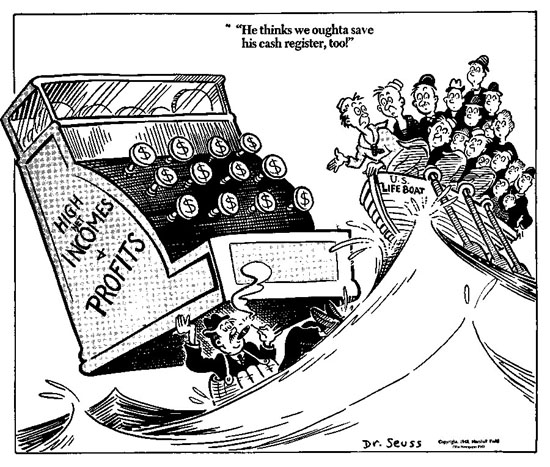

Inflation occurs from the markets having too much money invested in them and therefore need to have the money pulled out or the amount injected needs to slow down so the equilibrium can readjust. With the amount of money being injected in the banking systems, stock market and the housing market, it will impact the equilibrium once the market re-adjusts itself. Remember what we discussed about recessions in our previous articles. It is the readjustment of markets, and is necessary for our long term economical survival.

What should we prepare for?

Well, the first step should be the real estate market, as the prices got crushed in this housing depression, they will inflate before the adjust. Meaning a condo in Arlington, VA might be selling for $1 million in the next 5 years,which is currently selling for $400,000.

The second impact will be the rise of demand for natural resources, food and oil will be in high demand so will cement and steel, and less companies will exist that can provide them. Profits will go up in conjunction with demand and we could easily see gas prices crossing the $5 mark before readjusting at low $4’s. The cost of foods such as milk and rice are also expected to increase to record highs.

The third impact will be luxury goods such as cars, time pieces, jewelry (gold) etc. The value of the dollar will go up which will be expected but will cause the cost of goods that are not a necessity to increase significantly (which is why so many people want to buy your gold) and become more in demand.

During an inflation, consumer spending goes way up, and consumer confidence increases significantly. This is good and bad as America has very little self control around their spending, this can quickly cause another cycle to start quicker than before and we all know we don’t want another recession to take place in the next 3-5 years.

Consider yourself warned and understand the obstacles that face us before they happen.