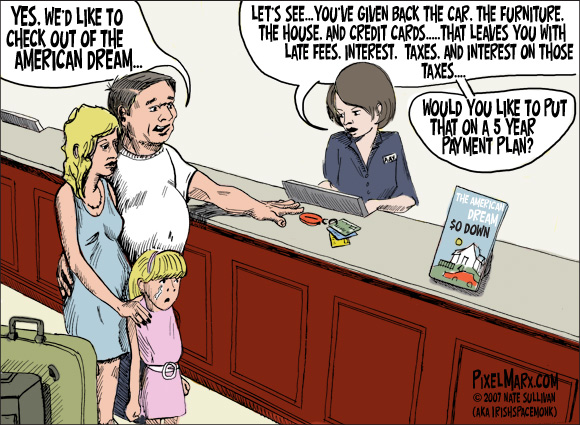

We often ask ourselves : Are we leaving within our means?

This is a hard question to answer as we could look at it from many different angles. If you refer back to our January article about saving, credit and greed you will have a better idea of what I mean by “within our means.”

Despite not living within our means, we are big spenders and in most cases rely on credit to do so. We are raised in this country relying on credit and our banking system to be available to us when we need. This is why Banks are the most profitable businesses out there (even in these hard times).

But what if we have no more access to credit?

As we have recently witnessed banks are holding back on all of us, they have cut back their spending tremendously causing a huge mess on main street by not allowing normal people access to credit. They are keeping their money in house and minimizing their exposure to debt and long term risk. This makes it very difficult for people to attain credit lines, car loans or even home equity loans and in most cases makes it impossible for businesses to operate as they have no access to capital to run daily expenses or take on more work. But how bad is it really?

If one has recently applied for a loan, they will know that it is definitely bad.

It has become almost impossible to qualify for even the simplest loans, even if you have a great credit score. So I ask you to re-decide if you are living within your means. Before you make your next large purchase, please consider the cost of your investment as the loan you get to finance it, might cost you.

A few years back, you had options, choices on who you pick to finance your purchase but times have changed and now you are limited on choices as the one you are offered might be the only one. Expect to pay higher rates no matter how credit worthy you are and be prepared to face smaller terms and higher payments, so I ask you to really reconsider large purchases and limit them to “necessities” and not “wants” that over extend your budget.