Credit is an important aspect of finance and while its importance has changed tremendously in the past 10 years, it is still one of the greatest financial assets one can have access to. However, it must be used with caution as one mistake may cost you quite a bit of headaches. Using credit responsibly can help you enhance your way of life by bridging your ability to make large purchases without leveraging your own money. It can also be used as a safety tool in ensuring that there is capital waiting for that rainy day in your personal or business life. If used well, credit can really help you enhance your financial situation.

After the great recession of 2008, many people destroyed their credit due to the real estate market coupled with years of bad financial decisions, including overspending. While you may have thought that once you destroy your credit then it becomes impossible to leverage, you couldn’t be further away from the truth.

As a matter of fact, here are five important facts about your credit that can help you raise your score and give you back the leverage you need to become debt-free.

The first and most important step of taking control is understanding your credit and not allowing all the myths behind the infamous FICO score to keep you from taking correct steps to a perfect 800+ score.

FICO scores range from 350-850 and are an algorithm to determine the likelihood that someone may default on a loan. While a FICO score is often referred to as a credit score, there are many variations of that same score being labeled as such by vendors and websites trying to sell you monitoring software. Your real FICO score is liquid and can change at any given time it is pulled, meaning that from one day to the next you could go from an 800 to a 600 and vice versa, which is even more reason why understanding your credit is the key to a successful 2017. Here is a breakdown of how to take full control before 2017:

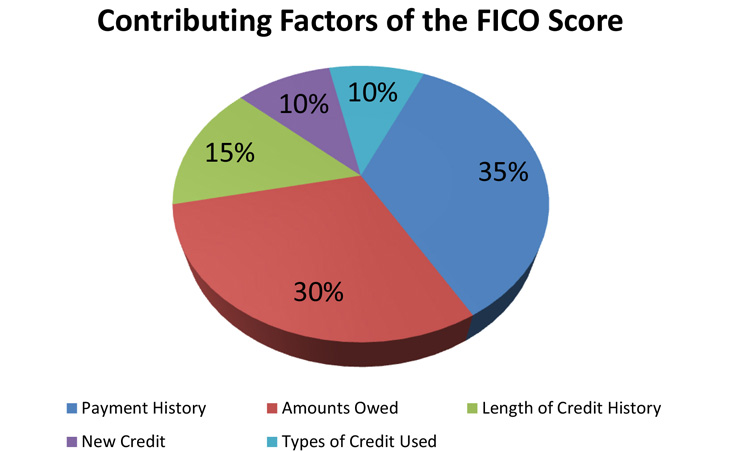

- 15% of your credit score is based on the average length of time you have had credit. Whether you have credit or not, opening a credit card regardless if it is secured or not will start establishing your credit history. Don’t delay, especially if you have no credit cards; take the first steps to establish new credit now. If you do have credit well established, don’t fall in the trap of closing down long standing accounts in 2016 just because you are no longer using those cards. Put them away rather than closing them, so you don’t lose the history and length of time some of your older cards have earned you.

- 30% of your FICO score is based upon what your current balances vs. credit limits. To have the best score possible, try to keep your balances below 30% ($300 balance on a $1000 limit card) or try to spread your balances between multiple cards and credit lines.

- 35% is based upon payment history, which identifies how have you paid on all of your previous and current accounts. Were you 30 days late a few times just because you failed to remember payment due date? These are things that can haunt you for 7 years and control the largest portion of your credit score. Collections and judgments are much worse and severely impact credit scores. If you have made a few mistakes that have no patterns related to them, consider writing a letter to the credit bureaus explaining the situation as many of them will agree to remove a few especially if there are no patterns in your defaults. If you have collections on the other hand, make sure to call the collectors and negotiate the debt down and pay them off before 2017. You’ll have to do it at some point, and now would be a good time.

- 10% is from your mix of credit. Do you have only credit cards? Banks and lending institutions like to see that someone is used to making consistent monthly payments such as a car payment or mortgage.

- 10% of your score is new accounts or inquiries for new accounts. It becomes a red flag to the credit bureaus if someone suddenly needs 10 or 15 new lines of credit; they begin to think you are looking to float money between accounts, because you may not be able to pay your bills. This is very important, because you could trigger this by taking massive steps to consolidate or clean up your credit in early 2015. Instead, start now so you can space out your consolidations.

By understanding this fairly simple aspect of how your credit score works, you are able to boost your score up as much as possible before 2017 and ensure that you continuously improve your credit rather than compromise it since great credit is an important aspect of fiscal responsibility to yourself.