How many millionaires do you know who have become wealthy by investing in savings accounts? That matter of fact would be enough of a reason to start investing and I could end this article on that note, but I realize that there are many individuals that are passionate about growing their wealth and would like concrete strategies on how to navigate the investment world.

Just about everyone is busy with their daily commitments that consist of showing up to work, providing for their family/loved ones, and seeing to their responsibilities. Thus I often get asked many times over and over as to how one can make added income and grow their wealth while staying within the confines of these constraints.

As great as it would be, not everyone is capable of starting and operating their own business (which may or may not succeed) or partaking in capital intensive business investments. In fact, many are too burdened and indebted to even consider such a task. So how do you make your money work for you without dumping large sums of money and committing your already depleted time?

You guessed it, by Investing of course. So how exactly do you invest? I will break down the process of how to not only start investing, but also doing it correctly and efficiently. Keep in mind that this does not constitute as investment advice, nor is it extensive or takes into account each person’s specific circumstance.

Let’s Begin

Many of us were in some way, shape, or form affected by the global financial crisis that took place in 2008. Millions lost their jobs, homes, and worse, some even lost their lives due to the angst and desperation that transcended upon them during that time. It was a horrific time, but the media and society has put the fear mongering on constant loop and thus it has stayed in the back of the minds of many people. After all, fear breeds obedience and indecision.

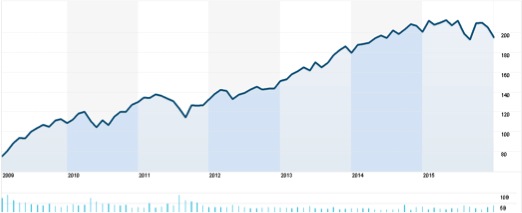

If anyone actually looked at the financial markets the year after the crash of 2008 and measured the gains up until the end of 2015, they would see that the market gained over 145% in the span of 6 years!

What does a 145% return on investment mean exactly? Let’s translate that in to easy to understand numbers that will make more sense.

Here are the gains for the SPY – An ETF that effectively mimics the S&P 500 US Index. Each share of the SPY ETF cost about $78 on January 1, 2009 and $194 on January 1, 2016 respectively. Now if you invested $10,000 on January 1, 2009 and didn’t touch that amount up until January 1, 2016, your initial $10,000 would now be worth $24,871.79! To be precise, that is a 148.72% return on your investment. This is not even including average yearly of 2%. If you reinvested that and with the power of compounding (we will touch on that below) you would have made even more. Ask yourself, what exactly did you do besides investing your money and letting it sit? I’ll tell you what, nothing! You literally made your money work for YOU!

SPY ETF Price Chart from January 1, 2016 to January 1, 2016

Investing in the overall market for a longer investment term can reap fantastic results. Where things get more exciting and fun is when you increase your risk tolerance and invest in individual stocks like Netflix, Microsoft, Apple, Google (Alphabet now) and countless others, where you can achieve even more outsized returns.

Now that you have an idea of how investing in certain equities in the financial markets can provide you with not only income but also build your wealth, let’s move on to 4 strategies you can implement today to start taking advantage of investing in the markets and grow your wealth.

- Enroll In Your 401k Plan at Work

If your company offers any sort of retirement plan, get in it. It’s a painless way to save and invest. Your company will automatically deduct money from your paycheck and put it into an investment fund for you.

Even better, most companies actually give you extra money as an incentive to enroll. So for every $1 you put into your retirement account, they will kick in 50 cents or $1 too. (There’s usually a limit to the company’s generosity, but ask your Human Resources department to help you set it up so you are taking advantage of all the money the company is willing to give you.)

In terms of how to invest your 401k, if you just want to set up an account and forget about it, put your money into anything similar to an “Overall Market Fund” which essentially holds large company stocks and/or replicates the markets.

If you’re willing to do more research, you should consider selecting which stock funds to invest in yourself. This takes more time, but if you are smart about it, you can sometimes pay lower fees and have better returns than the Overall Market Fund.

- Take Advantage of a Roth IRA

When investing in the financial markets, it is a well known fact amongst well versed investors and industry veterans that making the most of your Roth IRA can amplify your gains by simply keeping Uncle Sam’s greedy hands away from your returns.

Using a tax sheltered account like the Roth IRA means that anything you earn within the account is yours to keep. So if you contributed $10,000 in your Roth IRA as per our example above and at the begging of this year you decided to cash out your capital gains, you would effectively pay nothing, zero, zilch, nada in capital gains tax on the added $14,871.49 that you made. How is that for keeping the tax man off your back?

The Roth IRA is specific to the United States of America and for Canadian investors; there is an account with very similar qualities that is called the TFSA (Tax Free Savings Account). Majority of other countries also have their own respective accounts that are similar.

Keep in mind that every person’s situation will be different and some account types are more beneficial than others.

- Invest More – More Often

Did you get some money for Christmas or a work bonus? Ask yourself if you really need to spend it on that new iPhone or drone. Imagine how much happier you’ll be if you use it to make even more money with that money.

Since 1925, the markets have had an average return of 10.2% a year. Most people’s salaries don’t go up nearly that much every year.

I often tell people to go in with the mindset that every dollar they invest, they can ultimately afford to lose. Does that mean you will likely go bust? No it does not. It all depends on the type of investments you make, the strategies in place and most importantly, the time horizon. It’s very likely that you will make money over time, but it could take a couple years for you to really start seeing sizable returns.

Good morning hustlers, what are you doing today to make your goals a reality? Check out https://t.co/vRCgdngIEj pic.twitter.com/yDVBBT99eO

— Secret Entourage (@SecretEntourage) 4 de marzo de 2016

Look at your savings. Calculate how much you need to live for a few months if the worst case scenario happened. Maybe that’s $5,000 or $20,000. That’s the “rainy day fund” that you should not invest. The remainder, you should consider investing. Holding cash in any savings account at the bank will do squat. In fact, every dollar you hold in the account will be worth less the next year if you account for inflation.

- The Power of Compounding

Most people know that it is wise and makes sense to save more every month for retirement, funding college expenses, or some other financial goal. Yet we keep putting it off for one reason or another, “I’ll do it when the situation is a bit better” we say. With that mindset, you are robbing yourself of the potential to earn money on your money.

Let me explain how each and every dollar you invest now can go much further then that same dollar you invest tomorrow.

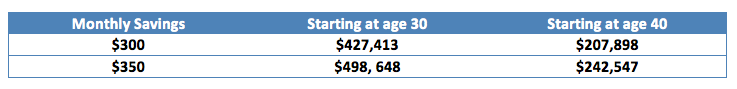

Let’s consider the difference between saving $300 per month at age 30 compared to age 40. Simplify the example by ignoring taxes, and assume you earn 6% on your money. If you start at 30 and continue until age 65 (span of 420 months), you will accumulate $427,413. If you wait until age 40 and continue to age 65 (span of 300 months), you will only have $207,898.

Now what about the difference between saving $300 and $350 using the same assumptions?

The numbers speak for themselves.

- Dollar Cost Averaging

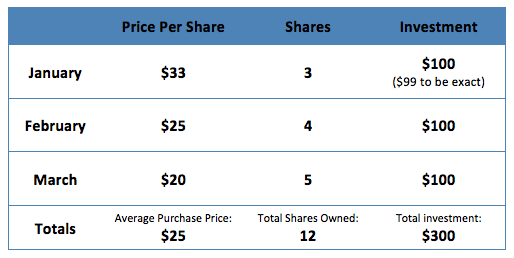

Dollar Cost Averaging (DCA) is a very effective method of decreasing your average cost over the long term and hedging your risk. It is also ideal for those making smaller fixed amount contributions. DCA is the technique of buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. More shares are purchased when prices are low, and fewer shares are bought when prices are high.

Eventually, the average cost per share of the security will become smaller and smaller. Dollar-cost averaging lessens the risk of investing a large amount in a single investment at the wrong time.

For example, you decide to purchase $100 worth of Apple shares each month for three months. In January, Apple is worth $33, so you buy three shares. In February, Apple is worth $25, so you buy four additional shares. Finally, in March, Apple is worth $20, so you buy five shares. In total, you purchased 12 shares for an average price of approximately $25 each.

Strive for Financial Freedom, Not Money

Investing to me is not only a way to grow wealth and achieve sustainable financial security, but also a way of life. Rome wasn’t built in a day, and neither will your fortune, but if you make the firm intention and commitment to invest in your future, I am positive your future self with thank the current you and wish you had done it sooner!

“The above references an opinion and is for information purposes only. It is not intended to be investment advice. Please seek a duly licensed professional for any investment, legal and tax advice.”